Getting The Pkf Advisory Services To Work

Table of Contents9 Easy Facts About Pkf Advisory Services DescribedPkf Advisory Services Things To Know Before You Get ThisThe Main Principles Of Pkf Advisory Services Fascination About Pkf Advisory ServicesGet This Report on Pkf Advisory Services

Choosing a business evaluation expert on the basis of cost might be tempting (PKF Advisory Services). This is especially the case for startups with tight budget plans, or organizations in some level of distress.Low-end providers typically keep their rates down by cutting corners and not executing adequate due diligence. The resulting evaluations tend to do not have the required roughness and thoughtfulness required to completely support the value estimate. This can lead to: Audit challenges. Additional expert charges. Prospective tax fines. Delays in completing audits in a prompt style.

Historic purchases are really handy in finishing specific valuation analyses. Nonetheless, overreliance on deals from past 12 months before the Assessment Day may be a red flag. It can signal you that the requisite upgraded persistance was not completed in the establishing evaluation concerned. A report might want if it does not include thorough economic details.

The adhering to are numerous acknowledged qualifications worth noting: A business assessment specialist with both breadth and depth of experience is most likely to have experienced and solved a range of valuation difficulties. They will be more probable to recognize the critical subtlety of the assessment process handy. Confirm that your specialist is prepared and ready to stand behind their evaluation.

Some Known Factual Statements About Pkf Advisory Services

This sign-off offers as an assurance of the record's precision and the stability of the evaluation process. Failing to have actually individual certified expert(s) authorize off on your report can threaten third-party acceptance.

Your professional should present the full financial picture of a firm. It needs to consider all pertinent variables that can affect its value.

We can assist you at any type of vital point of the valuation process. We take advantage of a diverse team of tax obligation, bookkeeping, deal and guarantee experts.

Rumored Buzz on Pkf Advisory Services

We give support in litigation matters and keep a check on conformity with the laws. Enterslice's evaluation & economic advisory services help companies to create monetary strategies straightening with the long-lasting goals of business by executing evaluation on the efficiency of economic activities, identifying the development, and supplying the techniques to use the resources and appropriate appropriation of disputes.

Collect information on the market fads and dynamics. Analyze the regulative needs and compliances to ensure adherence to the legislations. Accumulate the market data and sector trends. Conduct a thorough analysis of the economic transactions. Determine the threat that is impacting evaluation and monetary advising interactions. Apply control of the top quality procedure to make certain precision.

Collect information on intangible possessions, such as goodwill, copyright, and so on, pertaining to business. Preparing the reports based on the searchings for and giving the techniques to get useful content rid of such obstacles. Give specialist growth possibilities to enhance skills. Enterslice's Valuation & financial advisory solutions help in the examination of the profile funds, which includes a technique that intends to examine the performance, danger and prospective investment within the portfolio.

Some Known Questions About Pkf Advisory Services.

A can also be utilized for strategic preparation objectives, such as recognizing areas for improvement, setting targets, or examining financial investment chances. By understanding the worth of a service, proprietors, and managers can make enlightened decisions concerning the direction and development of the company. generally involve assessing monetary declarations, evaluating market problems, evaluating the firm's staminas and weaknesses, and making use of various valuation approaches to figure out the reasonable market price of business.

Some common kinds of consist of: - which concentrates on go to my blog the value of the firm's assets and obligations. - which contrasts the firm to similar services in the very same industry. - which determines the worth of the company based on its predicted future earnings. Service entail several approaches for identifying the worth of a company or business.

Some of the most typically utilized company assessment techniques consist of:: entail computing the net value of the company's assets, including concrete possessions like residential or commercial property and tools, as well as abstract possessions like licenses and trademarks. PKF Advisory Services. The value of liabilities is then deducted to get to the internet possession value

All about Pkf Advisory Services

Amongst the contributing aspects for the high failure price is a lack of a compelling business occasion for modification within the organisation, unrealistic assumptions when it involves delivery timelines, and inadequate financial investment in value monitoring, according to McKinsey. As a matter of fact, in an additional study carried out by McKinsey, where 5400 IT tasks were researched, it was discovered that usually, huge IT jobs run 45% over spending plan and 7% with time, while delivering 56% much less worth than anticipated the renowned "ROI".

We take an unique, multi-disciplinary approach to our technique, and our ability is flexible. Our litigation history allows us to work from a more defensible way of thinking and develop records that constantly withstand one of the most intense scrutiny from click to investigate the internal revenue service, auditors, courts, and opposite guidance. Because of this, we are typically contacted us to affirm in court as professional witnesses throughout the United States.

It is at this point they may take into consideration getting a business assessment. What specifically are company assessments? A firm appraisal will examine the precision and validity of financial records and accounts to make sure every little thing's up-to-date and in order.

Independent auditors are engaged to make a point of view on whether a firm's financial statements are provided relatively adhering to the applicable financial coverage framework. To develop an objective point of view, auditors will gather every one of the proof they need till they obtain a reasonable assurance. The opinion an auditor kinds is devoid of any bias and outside influences.

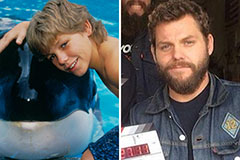

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now!